In a world where economic instability often seems just around the corner, understanding the complex nature of phenomena like inflation and deflation becomes paramount. These are not just terms that fill the mouths of economists; they shape the lives of everyday people. The Federal Reserve’s role in managing these economic factors is crucial, yet often only understood in response to immediate crises rather than in the steady, ongoing management of the economy.

Inflation can be perceived as a specter haunting the economic corridors of power, pushing central banks like the Fed to adjust levers that can affect everything from our mortgage rates to the bread we buy. However, the oft-vilified inflation is not inherently evil. Historically, moderate inflation has facilitated business investment and expansion by making future cash flows less expensive in today’s terms. But when left unchecked, it spirals into hyperinflation, eroding savings and disrupting economic balance as seen in historical scenarios like Zimbabwe or Argentina.

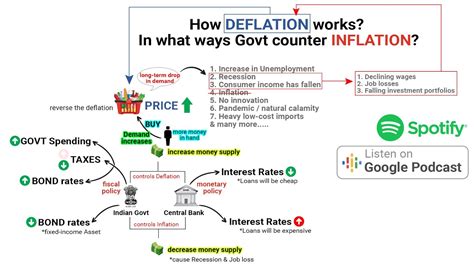

Conversely, deflation, often romanticized for reducing prices and enhancing purchasing power, can lead to severe economic downturns. It encourages consumers to delay purchases in anticipation of lower prices, slowing economic activity to a crawl. This was palpably felt during the Great Depression of the 1930s in the United States, where deflation coupled with high unemployment created a vicious cycle of economic stagnation.

Japan’s experience with deflation has been frequently debated. While it might seem appealing that goods and services become cheaper, the reality of prolonged deflation is a testament to its dangers—stifling economic growth and innovation. The perceived benefits of deflation in making daily goods more affordable are overshadowed by the broader economic malaise it induces, including limited job growth and conservative business investments.

Central to understanding these phenomena is the recognition that both inflation and deflation are results of mismatches between the supply of money and the value of available goods and services. Such mismatches can stem from government policies, shifts in consumer sentiment, technological changes, or external economic shocks. The Federal Reserve and other central banks strive to manage these mismatches through monetary policies such as adjusting interest rates, manipulating the money supply, and direct interventions in financial markets.

One contentious issue in monetary policies is the influence of government actions on economic outcomes. During the 1930s, policies aimed at avoiding wage reductions led to higher unemployment as businesses coped by cutting jobs rather than wages. This historical lesson underscores the unintended consequences of well-intentioned government policies. In modern contexts, debates abound regarding the role of government in either exacerbating or alleviating economic crises through fiscal and monetary measures.

Looking forward, the challenge for policymakers is balancing short-term economic needs with long-term goals. Strategies like quantitative easing or adjusting federal fund rates are not just mechanical adjustments but are reflective of broader economic theories and their practical impacts. Discussions about whether to prioritize fighting inflation or stimulating growth through low interest rates continue to dominate economic discourse.

As we navigate these complex economic terrains, the feedback from both economists and the general public plays a crucial role. Public sentiment and economic theory often diverge, creating a landscape where policy decisions can range from being hailed as proactive to being seen as exacerbating existing problems. Understanding this interplay between theory, policy, and public perception is essential for crafting responses that not only stabilize but also enrich the economic landscape for all involved.

Leave a Reply