The recent discussions on taxation policies in the United States have sparked a contentious debate surrounding the wealthiest Americans and their tax obligations. One of the key points of contention revolves around the concept of unrealized income and whether it should be subject to taxation. While some argue that taxing unrealized gains is a fair way to ensure that the ultra-rich contribute their share, others view it as a complex issue that could have far-reaching consequences.

One of the prevailing arguments against taxing unrealized capital gains is that it might disincentivize long-term investments and lead to unintended consequences in the stock market. Critics of such proposals raise concerns about the impact on retirement portfolios, day-to-day investors, and overall market stability. The intricate nature of wealth taxation highlights the challenges of balancing economic incentives with equitable tax systems.

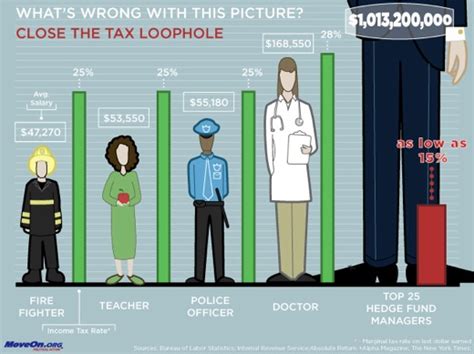

The notion of tax loopholes, particularly in relation to intentional policies that benefit the wealthy, has been a focal point of the debate. While some defend existing provisions as legitimate tax benefits, others point out instances where affluent individuals exploit these loopholes to minimize their tax liabilities. The case of billionaires leveraging borrowing practices to defer taxes and the complexities of estate planning underscore the disparities in the current tax framework.

Critics of the current tax system argue that the wealthy have the resources and influence to shape policies in their favor, creating an uneven playing field where the burden falls disproportionately on the middle and working classes. Discussions on fairness, transparency, and the distribution of tax responsibilities highlight the need for comprehensive tax reforms that address income inequality and close existing loopholes.

As the debate rages on, questions arise about the effectiveness of the tax system in reflecting modern wealth structures and ensuring equitable contributions from all segments of society. Calls for greater transparency, accountability, and progressive taxation policies echo across various sectors, challenging policymakers to rethink existing frameworks and strive for a more balanced and just tax system.

Moving forward, the conversation on taxation policies is poised to shape economic discourse and drive legislative changes aimed at promoting financial equity and accountability. By examining the nuances of tax structures, wealth distribution, and the impact of loopholes on income inequality, stakeholders can work towards creating a more inclusive and sustainable tax environment that benefits society as a whole.

The complexities of wealth taxation, asset valuation, and income streams necessitate a nuanced approach to tax policy that considers both economic incentives and social impact. Balancing the needs of diverse stakeholders, from individual taxpayers to corporate entities, requires thoughtful analysis and collaboration to develop a tax system that fosters economic growth while addressing disparities in wealth accumulation and tax obligations.

As we navigate the intricacies of tax legislation and reform efforts, it becomes evident that the dialogue surrounding tax loopholes, unrealized income, and equitable taxation is multifaceted and multifaceted. By engaging in constructive debates, critical discussions, and evidence-based policy evaluations, we can progress towards a tax system that upholds principles of fairness, progressivity, and fiscal responsibility. The ongoing discussions on tax policies present an opportunity to rethink, refine, and reshape the tax landscape for a more equitable and sustainable future.

In conclusion, the discourse on tax loopholes and wealth taxation underscores the need for a comprehensive approach to address income inequality, promote financial accountability, and ensure that the wealthiest Americans contribute proportionally to society. By delving into the complexities of tax structures, wealth management strategies, and legislative frameworks, we can strive towards a more just and transparent tax system that serves the interests of all citizens.

Leave a Reply