The dominance of FICO in determining creditworthiness has increasingly come under scrutiny, particularly given the opacity and rigidity inherent in its scoring algorithms. Many individuals find themselves at the mercy of a seemingly implacable system, with little understanding of what affects their scores. This lack of transparency feeds a cycle of financial instability, where individuals struggle to improve their scores due to unclear metrics. It’s a prime example of **regulatory capture**, where government policies inadvertently solidify corporate monopolies, limiting competition and innovation. The comments on issues like this indicate a strong desire for alternative models that democratize understanding and control over credit scores.

One potential disruptor to this monopolistic stranglehold is open-source credit scoring. Open-source software has revolutionized fields from operating systems to artificial intelligence, and there is no reason it can’t do the same for credit ratings. The idea is simple: develop an open-source algorithm that becomes the standard for credit scoring, allowing anyone to inspect, modify, and improve the code. Open-source credit scoring could dramatically increase transparency, enabling consumers to understand exactly how their actions impact their scores. It could also level the playing field, offering non-discriminatory access to credit evaluations. **Harmohit** suggests, “It will also offer the lay person insights into how the credit rating is exactly determined,” which is a sentiment echoed by many frustrated by the opaque nature of current systems.

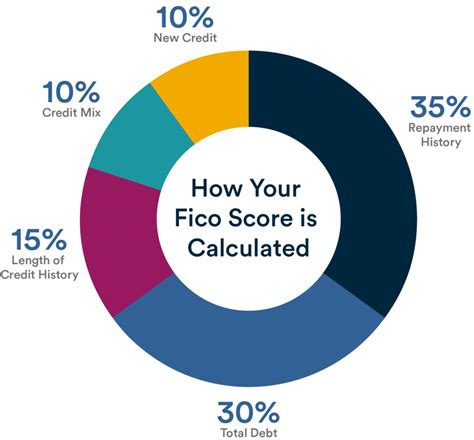

However, simply making the algorithms open-source is not a panacea for all the issues plaguing the credit scoring industry. **Akira2501** notes that many of the elements contributing to credit scores are straightforward: keeping inquiries to a minimum, not maxing out credit lines, and maintaining old accounts. Yet, users often misinterpret these factors or become ensnared by financial behaviors that negatively impact them. An open-source model would need to provide not only transparency but also education. It should empower users by offering actionable insights and strategies for improvement, moving beyond the trite tips often found in misleading online videos. The implementation of an open-source system could foster healthier financial habits and elevate the overall financial literacy of the populace.

The current environment, described as a ‘cartel’ by many, is a breeding ground for anti-competitive practices. **Mschuster91** condemns the practice of penalizing consumers for multiple credit inquiries, labeling it as anti-competitive. This is a typical grievance against the entrenched nature of current credit reporting systems. Eliminating these unfair practices requires pressure from both the public and regulatory bodies to adopt more equitable standards. Transitioning to an open-source model would undoubtedly face resistance from established powers, but the potential for a more equitable system justifies the effort. Moreover, government mandates could play a crucial role in this transformation, compelling institutions to adopt and support open-source solutions that prioritize consumer interests over profit margins.

Lastly, it’s essential to acknowledge that the complexities of the modern financial ecosystem cannot be entirely dismantled in favor of simpler, more idealistic solutions overnight. **Dalewyn** points out that banks fundamentally operate on risk assessments; they seek to minimize their exposure to losses. Open-source models must recognize and integrate legitimate risk factors without becoming punitive or exploitative. Additionally, as **Retric** comments, hidden fees and inflated costs in industries like mortgage lending further highlight the need for systemic reform that accompanies any new credit scoring model. As such, ongoing dialogue, codified best practices, and rigorous standardization will be crucial to ensure that an open-source credit scoring model is sustainable, reliable, and, above all, fair.

In conclusion, while the current credit scoring system has its merits in terms of efficiency and risk assessment, its monopolistic and opaque nature is ripe for disruption. Embracing open-source algorithms and transparent practices can democratize credit scoring, benefiting both consumers and lenders. As the debate around FICO and credit bureaus continues, it’s imperative for lawmakers, technologists, and consumers to work collaboratively to promote a system that is fair, transparent, and competitive, potentially transforming the financial wellbeing of millions.

Leave a Reply